Thirty Years Ago Today…October 19, 1987

Fear can be headier than whiskey, once a man has acquired a taste for it.

Donald Dowes

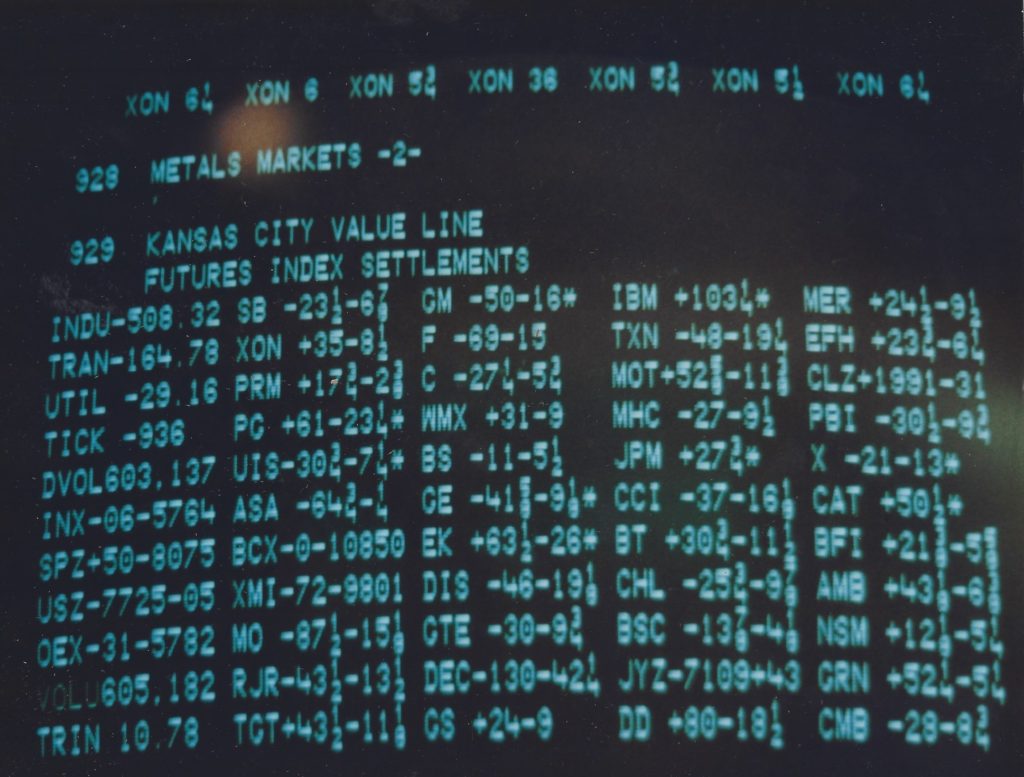

Take a close look at this picture. It was taken thirty years ago today, October 19, 1987, from a trader’s Quotron machine in New York City. To the untrained eye it’s a messy gobbledygook of confusing letters and numbers. But it’s actually a seminal piece of American history, a snapshot of what a financial panic actually looks like. A day forever known on Wall Street as Black Monday.

If a picture is worth a thousand words, then you know I’ll use two-thousand. The following is an appendix that goes along with the story of that incredible day.

INDU – 508.32. That’s the first thing you notice (located in the first column, near the upper left-hand corner) Translated, it means the Dow Jones Industrial Average closed that day roughly 508 points lower than the previous day’s close. Think about that. On Friday, October 16, the Dow Jone Industrial Average closed at 2,246, and on Monday it closed at 1738. That’s a loss of 22.6% in A SINGLE DAY! To put it in perspective, the Dow Jones Industrial Average closed yesterday, October 18, 2017 at 23,157. Imagine if the index dropped 5,233 points this afternoon to close at 17,924. Who would President Trump blame for that?

CMB 28 -8 ¾, CHL 25 ¾ – 10, BT 30 ¾ -11 ½, MHC 29 – 9 ½. These are the stock symbols for Chase Manhattan Bank, Chemical Bank, Bankers Trust and Manufacturers Hanover Bank. They don’t exist anymore. Neither do stocks prices quoted in fractions.

SB 23 -6½, BSC 13 7/8 -4 1/8, EFH 23 ¾ – 6 ¼. I miss old line investment banks like Salomon Brothers, Bear Stearns and E.F. Hutton. I don’t think anyone else does.

DEC 130 – 42 ¼. Digital Equipment Company, the “must own” stock of the mid-80’s. This white-hot company burned out faster than Duran Duran. I just can’t see that happening to Amazon.

DVOL 603,137. Of the 605 million shares traded that day on the New York Stock Exchange, a staggering 603 million shares traded down in price. For what it’s worth, average daily volume on the New York Stock Exchange in 1987 prior to Black Monday was roughly 35 millions shares. No wonder the bars stayed open late that night.

GM 50 -16, F 69 -15, C 27 ¼ -5 ¾. General Motors, Ford, and Chrysler. No one was ever going to buy a car again.

MO 87 ½ -15 1/8, RJR 43 ½ -13 ½. Phillip Morris and RJ Reynolds. No one was ever going to smoke again. Not that there was anything wrong with that.

DIS 46 – 19 1/8. No one was ever going to Disneyland again. Going forward, fun would have to be rationed.

PG 61 -23 ¼. Procter & Gamble. No one was ever going to buy toilet paper again.

EK 63½ -26. No one was ever going to buy Kodak film again. Come to think about it, no one does. I guess the sellers were early.

What you don’t see on the screen are stocks with four letters in their symbols, which means the trader who took this picture only traded stocks listed on a physical exchange. Back then, over-the-counter (OTC) stocks, like Apple (AAPL) or Microsoft (MSFT), traded not at a physical “place” like the New York or American Stock Exchange, but rather on a network of trading relationships organized by brokers and dealers who acted as market makers. For example, if an OTC trader at First Boston wanted to buy or sell AAPL, he got on the phone to bid or offer the stock to Goldman Sachs or some other broker/dealer. As a consequence, OTC markets were less transparent and operated with fewer rules than the NYSE. That’s why, on October 19, there wasn’t very much trading in OTC stocks. Brokers sat at their desks and simply refused to answer their phones. Truth be told, many of them spent the day hiding under their desks.

Historians analyzing the Stock Market Crash of 1987 point to structural flaws inherent with “program trading” that were tied to an investment strategy called “portfolio insurance.” That sounds very sexy and all, and is technically correct. But I would argue that the most basic of human emotions, fear, contributed just as much to the panic. Just two months earlier, on August 27, the Dow Jones closed at an all-time high of 2,722. So by mid-October, most investors had already lost years of hard won gains. Moreover, during the previous three days of trading (Wednesday, October 14 to Friday, October 16), the Dow Jones fell from 2,508 to 2246, a lost of over 10% in just three days. Imagine what panicky investors were thinking during that anxious weekend after their portfolio had already dropped almost 18% in just two months. Three words come to mind. Get. Me. Out.

I witnessed the greatest crash in Wall Street history from the Atlanta office of The First Boston Corporation, located 42 stories above Peachtree Street. I had been working on Wall Street for a whopping 14 months, and I had about $400 in my 401k. When i wasn’t staring at my computer screen I was looking out the window, wondering if I’d have a job the next day. Lucky for me, the windows were sealed.

So here’s the question on everyone’s mind. Can a stock market crash like the one that occurred on Black Monday ever happen again? I would say the odds of history repeating itself are the same as a reality television star being elected President of the United States.

Happy Anniversary.

One Response to Thirty Years Ago Today…October 19, 1987